News

Minimise year end opportunities and minimise risks

Posted: 01 April 2015

The end of the financial year will be here before you know it.

In this end of financial year update, we have summarised some of the key ways you can minimise your tax and reduce your tax risks prior to 30 June.

Plus, to ensure you are prepared for the new financial year, we’ve outlined some of the key issues you should be aware of.

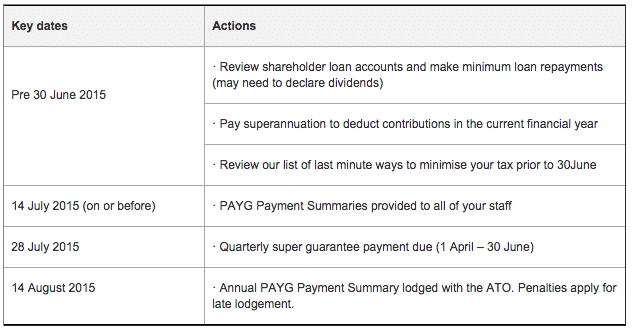

Key Dates

Your End of Financial Year Obligations

Consider this Financial ‘house-keeping’:

Software

Before rolling over your accounting software for the new financial year, make sure you:

- Prepare your financial year end accounts. This way, any problems can be rectified and you have a ‘clean slate’ for the 1025/2016 year. Once rolled over, the software cannot be amended.

- Do not perform a Payroll Year End function until you are sure that your payment summaries are correct and printed. Always perform a payroll back-up before you roll over the year.

PAYG Payment Summaries

You need to provide all of your staff with their PAYG Payment Summary on or before 14 July 2015. This includes any staff that left your employment during the 2014/2015 financial year.

The ATO imposes penalties for the late lodgement of their PAYG Summary Statements with penalties of up to $2,750.

The annual PAYG Summary Statement for the year ending 30 June 2015 needs to be lodged with the ATO on or before 14 August 2015.

Reportable Fringe Benefits on PAYG Payment Summaries

Where you have provided fringe benefits to your employees in excess of $2,000, you need to report the FBT grossed-up amount on their PAYG Payment Summary. This is referred to as a “Reportable Fringe Benefit”(RFB) amount and you will notice that a label is included on the PAYG Payment Summary for this purpose.

You might not need to do a stocktake – using the simplified trading stock rules

Small Business Entities (operational businesses with an aggregated turnover below $2 million) have access to a range of tax concessions. One of these concessions is the simplified trading stock rules. Under these rules, you can choose not to conduct a stocktake for tax purposes if there is a difference of less than $5,000 between the opening value of your trading stock and a reasonable estimate of the closing value of trading stock at the end of the income year. You will need to record how you determined the value of trading stock on hand.

If you would like to take advantage of the simplified trading stock rules, call us today to make sure you are eligible to use the simplified rules and to talk through how to use them properly.